What a recession in Charlotte might look like

Economists say Charlotte seems in better shape than in ’08 — but our fast-growing city isn’t immune from bigger trends

The following article was published in the Aug. 26, 2019, edition of the Charlotte Ledger, an e-newsletter on local business news. Sign up for free here.

Nobody likes to talk much about the prospects of the dreaded “r” word — recession. They’re psychological and self-fulfilling. If people believe a recession is approaching, they cut back on spending, businesses stop investing, and that makes the economy worse.

But in the last few weeks, hubbub about the next recession seems to have increased:

- In a survey released last week, 38% of economists predict the U.S. will enter a recession in 2020, and 34% predict it will happen in 2021.

- One technical measure that has predicted previous recessions — a flipping of the yields on two different kinds of Treasury notes, known as the “inverted yield curve” — has taken place several times in recent weeks, most recently on Friday afternoon.

- The stock market has been falling. While major indexes are still up for the year, they have lost ground each of the last four weeks — largely over concerns about international trade. The Dow plunged 623 points on Friday.

Charlotte effect: What would a recession look like in Charlotte? The city has seen a recent slew of big job announcements, construction seems to be everywhere, and new shops and restaurants are popping up all over. A crippling recession seems hard to imagine.

The Ledger asked three economists about the local effects of a downturn. They seemed to agree that compared with other cities, Charlotte and its major industries seem in good shape — and they’re not convinced that a recession is inevitable. But if there were a downturn, Charlotte wouldn’t be immune from larger economic trends and the pain of a slowdown, either. Here’s what they had to say:

Mark Vitner, senior economist at Wells Fargo:

On the sources of economic weakness: “What’s unique about this period is that almost all of the uncertainty and weakness is coming from overseas. Charlotte doesn’t really have that much exposure to that. We are not a port city. … Most of what is dragging the economy down right now has to do with what is going on with the global economy.”

On what sectors will get walloped: “One of the things that seems to be constant over the course of recessions is the parts of the economy that grew the fastest tend to get hit the hardest. That’s where the excesses tend to be the greatest.”

On housing: “If we were to have a recession, the housing market would be sideways to down a little bit, but it wouldn’t be ground zero for a recession.”

On commercial real estate: “There’s been a tremendous run-up in value for commercial properties. Buying income-producing property has been one of the more attractive ways to earn yield in a low-interest-rate environment.”

On banking: “In the last recession, it was centered in the financial sector, and Charlotte is a major financial center. … The banking sector is very healthy, and it has been becoming more efficient.”

Michael Walden, N.C. State economist:

On sectors that would see a downturn: “They tend to be those products and services that households and businesses don’t have to buy on a daily basis. So housing, vehicles, furniture and even electronics would experience falling sales. Even though Charlotte may not have manufacturers in all these areas, the region does have retailers.”

On international trade: “Any business that is involved in global trade — as a purchaser of inputs, or selling into foreign markets — they are being challenged right now.”

On signs of a recession: “You would expect to see businesses that had some expansion plans put them on the shelf. Commercial real estate is something to watch. If you start to hear that somebody who announced something a week ago is now holding off, that would be a troubling sign.”

John Connaughton, UNC Charlotte economist:

On banking: “In the last downturn, we suffered pretty badly as a result of Wachoviaand the change in ownership there and banks in general. We are less susceptible to that now than we were in 2007 and 2008.”

On why Charlotte has less international exposure than you might think: “In the area, we have hundreds of foreign companies — predominantly European, but also Chinese and Japanese. Most of these companies have set up operations here to make products for the North American marketplace. They are not export companies, with a few exceptions.”

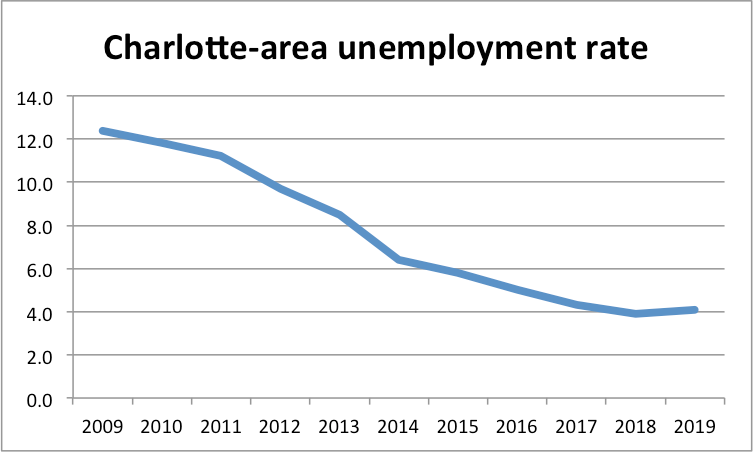

On what a recession would be like here: “It’s not going to be anything like 2008. The next recession we have is much more likely to be like the 2001 recession or the 1991 recession, when unemployment rates peaked around the 7% range. People lose their jobs, things slow down, but they last eight months.”

On Charlotte’s strength compared with elsewhere: “70% of the growth of the U.S. economy since 2000 has come from 30 metro areas. Charlotte and Raleigh are in that 30. … Will Charlotte slow down in a recession? Will the 30 top-growth MSAs slow down? Yeah. Are they likely to contract during that period? Not really. That doesn’t mean you won’t feel the pain. We will still be growing, just not as fast.”